Finance

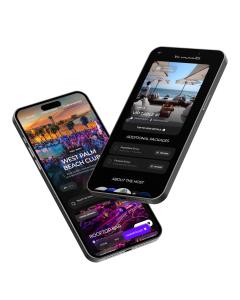

Irish Tech Pioneers Revolutionise Dubai’s Nightlife with Web3 Loyalty App

Finance

Coles credits Pokemon with lifting supermarket sales

Supermarket giant Coles has reported a significant growth in its supermarket sales for the quarter ending in March, thanks in part to a successful Pokemon collectibles campaign. The company’s grocery sales for the 12 weeks leading up to March 24 reached $9.07 billion, representing a 5.1% increase from the same period a year ago.

Coles attributed this success in part to the popularity of its Pokemon Builders campaign, which featured cardboard models as collectible items. Chief Executive Leah Weckert noted that the campaign helped boost sales compared to the previous year when no such collectible campaign was in place.

The increase in supermarket sales helped offset a drop in sales at Coles’ Liquorland chain, which saw a 1.9% decrease in sales totaling $786 million. This decline was attributed to customers reducing their discretionary spending on alcohol due to economic pressures, as well as the bottle shops transitioning away from less profitable bulk sales.

In addition to the success of the Pokemon campaign, Coles also saw strong growth in its e-commerce supermarket sales, which surged by 34.9% to $856 million. Online alcohol sales also experienced a 4.1% increase to $44 million. The number of customers using the Coles app each month also rose significantly, up by 44.1%.

Despite the overall growth in sales, Coles reported that total supermarket price inflation moderated to 2.2% in the latest quarterly figures, down from 3.0% in the previous period. This provided some relief to financially squeezed customers, with prices falling for certain fresh produce items while bakery prices rose due to wheat commodity prices.

To combat stock loss, Coles has implemented anti-theft initiatives like bar gates and “skip scan” technology in several hundred of its 851 supermarkets. Additionally, a new anti-theft feature called “bottom of the trolley” has been added to identify bulk items as they are added to a cart.

Coles’ half-year results from February showed the supermarket gaining traction on its competitor Woolworths. The upcoming third-quarter sales results from Woolworths, set to be reported on Thursday, will reveal if this momentum has continued.

Both Coles and Woolworths are currently facing public and political scrutiny, including state and federal parliamentary inquiries and an investigation by the competition and consumer watchdog over allegations of price gouging. Despite these challenges, Coles remains focused on providing value to customers and achieving continued growth in its supermarket sales.

Fashion

Retailers feel pinch as shoppers stay home, spend less

There has been a noticeable decline in retail sales in Australia as shoppers opted to stay home and cut back on non-vital spending in March. According to the official Australian Bureau of Statistics count, retail sales slid by 0.4 per cent, a figure lower than the 0.2 per cent increase predicted by analysts.

Factors contributing to the decrease in retail sales include higher mortgage repayment costs, a growing tax burden, and elevated prices impacting Australian consumers. Weakness in retail sales has particularly affected discretionary goods and services, with clothing, footwear, and personal accessory retailing falling by 4.3 per cent, and department store sales declining by 1.6 per cent.

The only segment to see growth in March was food retailing, which saw a modest increase of 0.9 per cent. Other industries, such as household goods retailing, other retailing, and cafes, restaurants, and takeaway food services, experienced decreases in sales for the month.

ABS head of retail statistics, Ben Dorber, noted that the 0.8 per cent increase in yearly spending compared to the previous year was the weakest growth on record outside of pandemic and GST-related fluctuations. Dorber attributed the decline in retail spending to ongoing cost of living pressures impacting consumers.

Following the release of the retail sales data, economists have expressed concerns about the impact of financial pressures on consumer demand. Sean Langcake, from Oxford Economics Australia, highlighted that vital inflation for items like health, education, rent, and mortgage costs is squeezing household budgets, leading to restrained discretionary spending.

The subdued retail sales figures come on the heels of unexpectedly high inflation data, which has dampened hopes for interest rate cuts in the near future. With price inflation affecting vital items, such as housing-related components, banks like the Commonwealth Bank have pushed back their projections for interest rate cuts from September to November.

CBA’s head of Australian economics, Gareth Aird, emphasized that while the Reserve Bank of Australia has succeeded in reducing inflation for non-vital items, vital components are proving more challenging. Aird suggested that strong population growth, driven by net overseas immigration, is contributing to upward pressure on the consumer price index basket, prolonging the decline in inflation rates.

As retailers face the impact of subdued consumer spending, analysts are closely monitoring economic indicators to gauge the health of the retail sector and the broader Australian economy.

Finance

Australian Consumer Confidence Reaches 20-Month High

Household budgets are still under pressure but green shoots of optimism are starting to sprout in the consumer sector.

Consumer confidence as measured in weekly and monthly surveys has been stuck deep in the doldrums as interest rates went higher and cost of living pressures intensified.

However modest improvements have been logged in recent months, coinciding with convincing progress on inflation and talk of interest rate cuts.

The March update of the Westpac and Melbourne Institute monthly survey, which is due for release on Tuesday, hit a 20-month high in February but was still below the 100 neutral mark.

Since then, consumers have observed a mixed bag of data, including a return to real wage growth – but only just – and a gloomy report card for the economy in the December quarter.

Also on Tuesday, National Australia Bank’s business conditions gauge for February is scheduled.

The private sector has proved resilient in the face of economic headwinds but the January update revealed waning momentum.

The business conditions gauge, which captures profitability, hiring movements and sales activity, broke a two-year streak of above-average conditions over the month, falling to just below that threshold.

At the same time, confidence in the business sector improved a little but was still below the long-run average.

Data on the total value of residential dwellings is also due from the Australian Bureau of Statistics on Tuesday, as well as a speech from Sarah Hunter, Reserve Bank assistant governor (economics) at the AFR Business Summit.

More insights into the consumer will be released on Wednesday, with Commonwealth Bank’s report on household spending due.

Monthly business turnover is also slated from the ABS on Wednesday, and then overseas arrivals on Thursday.

Meanwhile, the Australian stock market is expected to dip on Monday, after Wall Street ended narrowly weaker on Friday amid profit-taking by investors.

The decline followed a US labour market report that showed more new jobs than expected were created in February while the jobless rate rose to 3.9 per cent.

The US S&P 500 index lost 32.99 points, or 0.64 per cent, to end at 5,124.37 points, while the Nasdaq Composite lost 185.22 points, or 1.14 per cent, to 16,085.11.

The Dow Jones Industrial Average fell 66.28 points, or 0.17 per cent, to 38,725.74.

The soft finish led Australian share price index futures 47 points lower to 7811, paving the way for a softer start to the trading week.

On Friday, the local bourse closed above 7,800 points for the first time, on signals that interest rate cuts in Europe and the US could happen sooner rather than later, giving investors hope the Reserve Bank of Australia could follow suit.

The S&P/ASX200 finished at 7,847.0, up 83.3 points, or 1.1 per cent for the day and up 1.3 per cent for the week.

The broader All Ordinaries climbed 80.8 points, or 1.01 per cent, to 8,107.5.

-

Business2 years ago

How to Earn Money Writing Blog Posts in 2023: A Comprehensive Guide

-

Games2 years ago

How does Dead Space Remake enhance the Horror Classic of 2008

-

Video2 years ago

Everything you need to know about Starfield

-

Health2 years ago

How is Yoga and Pilates Bridging the Gap Between your Mind and Body

-

Health2 years ago

Migraine medications significantly improve the quality of life

-

World2 years ago

Swiss Pharma Powerhouse Acino Expands into Latin America with M8 Pharmaceuticals Acquisition

-

Self Improvement2 years ago

Enhancing Relationships and Emotional Intelligence Through Mindfulness Meditation

-

Business2 years ago

How to Use LinkedIn to Build Your Professional Brand